By Ivan Pereira

A new report released by the state comptroller Friday has painted a clearer picture of the mortgage crisis that has crippled southeast Queens over the last half decade.

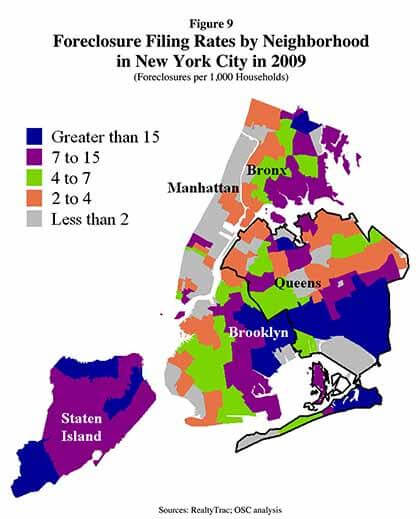

Comptroller Thomas DiNapoli’s 12-page study found that between 2006 and 2009, the number of foreclosures in New York City rose nearly 32 percent from roughly 17,000 to nearly 23,000 and the neighborhoods of Jamaica, Rosedale and South Ozone Park led the filings.

The increase was powered by a surge in subprime mortgages that were purchased by homeowners in the area, according to the report.

“In general, the foreclosure crisis in New York state and New York City was less severe than in other parts of the country. But neighborhoods in Brooklyn, Queens and the Bronx were especially hard hit,” DiNapoli said in a statement.

Queens led the state in the number of foreclosure filings in 2009, the report said. Jamaica topped the borough for the foreclosure filings per 1,000 households in that year, with a rate of 29.9, according to the comptroller.

The numbers are more alarming when seen in the context of the housing crisis. In 2006, when the rise in foreclosures began in Jamaica, the neighborhood had a filing rate of 19.7 per 1,000 households, the report said.

When the foreclosures are measured per 1,000 homeowners, Jamaica also fared worse than any other part of the borough with a rate of 35.4 in 2006 vs. 58.4 two years ago, according to the report.

The loss of homes is tied in with the rise of predatory lending in inner city neighborhoods and the jump in purchases of subprime mortgages, or home loans that start out with low interest rates that balloon quickly, DiNapoli said.

In 2004, there were 2,440 subprime mortgages offered in Jamaica, which accounted for nearly 28 percent of all home loans in the community, according to the report. Two years later, 5,581 loans, or roughly 54 percent of home mortgages in Jamaica, were given out in the neighborhood, the report said.

“The growing percentage of mortgages in the foreclosure process is a more precise indicator of the continuing fallout from the housing crisis and recession,” the comptroller said.

The report, however, does show some progress in the foreclosure problem in southeast Queens. The number of foreclosure filings dropped from 2,394 in 2009 to 1,262 last year, according to the comptroller. Rosedale also had a steep decline in foreclosures from 1,510 filings two years ago to 885 in 2010.

DiNapoli said the change was due to several banks that stopped their foreclosure proceedings last year after it was discovered that they did not properly process the paperwork.

“New York had a sharp drop in new foreclosure filings in 2010, but that drop can be attributed in part to a temporary suspension of foreclosure-related activity, not an improvement in the market,” he said.

The comptroller’s office has begun a new initiative to combat this trend. The Your Money New York program will give homeowners information and an access point for government financial help services.

Homeowners can log on to yourmoneynewyork.com for more information.

“We have to refocus our attention on solutions that will keep people in their homes, keep our neighborhoods safe and keep our economy on the road to recovery,” the comptroller said.

Reach reporter Ivan Pereira by e-mail at ipereira@cnglocal.com or by phone at 718-260-4546.